Resources/Resume-Guide/Accountant

Accountant Resume Guidance

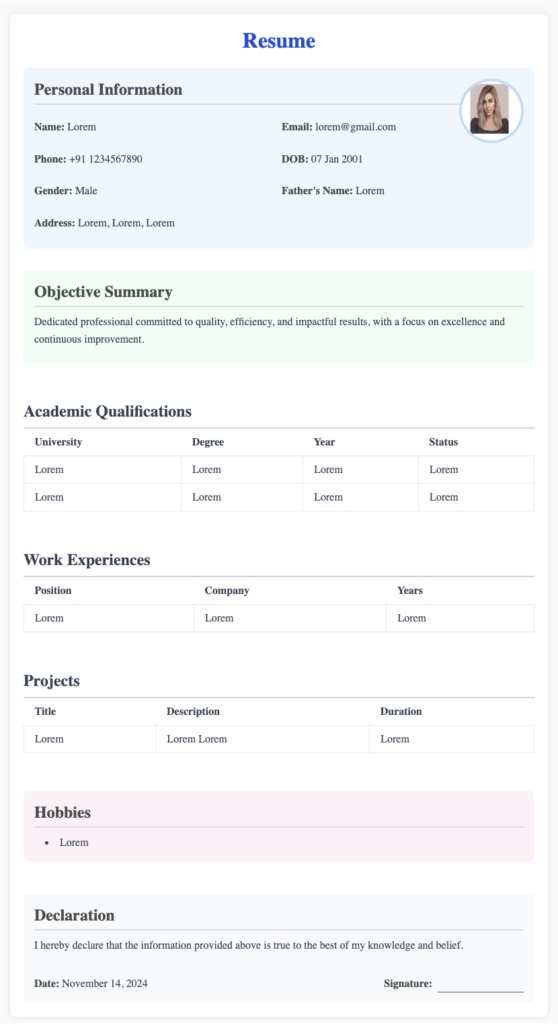

Creating a compelling accountant CV involves understanding what employers look for and presenting your qualifications in the best light. Here’s a step-by-step guide to help you craft a standout CV:

1. Tailor Your CV to the Job

- Understand the Job Requirements: Read the job description carefully. Identify key skills and experiences required, such as tax compliance, budgeting, or proficiency in specific software.

- Use Keywords: Incorporate relevant keywords from the job description to help your CV stand out in applicant tracking systems (ATS)

2. Structure Your CV

Follow a clean, professional structure to ensure readability:

Personal Details

Include your name, contact details (phone, email), LinkedIn profile, and city (not full address unless necessary).

Professional Summary

Use strong keywords related to accounting, such as “certified accountant,” “financial analysis,” “budget management,” and “compliance.”Highlight expertise, achievements, and key traits concisely. Aim for 3-4 impactful sentences.

Example:

1. “Certified Public Accountant (CPA) with a strong track record in financial analysis, tax compliance, and regulatory reporting. Skilled at optimizing accounting workflows, ensuring compliance with local and international standards, and delivering actionable financial insights to drive strategic decision-making. Proficient in leveraging tools like QuickBooks and SAP to enhance efficiency and accuracy in financial management.”

For Fresher

2.

“Motivated accounting graduate with a solid foundation in financial reporting, budgeting, and compliance. Proficient in utilizing accounting software like QuickBooks and Excel for accurate data management and analysis. Known for strong analytical skills, attention to detail, and a commitment to maintaining compliance with financial regulations”

Key Skills

- Use bullet points to improve readability.

- Include specific skills relevant to accounting (both technical and soft skills).

- Incorporate SEO keywords like “financial management,” “auditing,” or “GAAP compliance.”

Example:

For Experienced Accountants:

- Financial Reporting and Analysis

- Budgeting and Forecasting

- Tax Planning and Compliance (GAAP, IFRS)

- Audit Preparation and Execution

- Cost Reduction Strategies

- Advanced Excel and Financial Modeling

- Accounting Software (SAP, QuickBooks, Xero)

- Regulatory Compliance and Risk Assessment

- Leadership and Team Collaboration

For Fresher Accountants:

- Basic Accounting Principles (GAAP, IFRS)

- Financial Statement Preparation

- Budgeting and Forecasting Techniques

- Data Entry and Reconciliation

- Proficiency in MS Excel and QuickBooks

- Analytical Thinking and Problem-Solving

- Effective Communication and Teamwork

- Time Management and Organization Skills

Professional Experience

Use bullet points for clarity and impact.

Start each point with strong action verbs like “Prepared,” “Implemented,” “Streamlined,” or “Analyzed.”

Quantify achievements where possible (e.g., “reduced errors by 20%”).

Focus on job-relevant skills and accomplishments.

For Experienced Accountants:

Senior Accountant | [Company Name] | [Location]

[Start Date] – [End Date]

- Prepared and analyzed financial statements to ensure compliance with GAAP and internal policies.

- Streamlined the month-end closing process, reducing reporting time by 30%.

- Conducted audits and identified cost-saving opportunities, achieving annual savings of $50,000.

- Managed tax filings, ensuring 100% compliance with federal and state regulations.

- Supervised and trained a team of junior accountants, improving overall efficiency and accuracy.

- Implemented new accounting software, increasing data accuracy by 15%.

For Freshers (Internship or Entry-Level Role):

Accounting Intern | [Company Name] | [Location]

[Start Date] – [End Date]

Collaborated with senior accountants to analyze budget variances and financial trends.

Assisted in preparing financial reports, including balance sheets and income statements.

Conducted data reconciliation, ensuring accuracy in accounts receivable and payable records.

Supported the audit team by organizing and verifying financial documentation.

Gained hands-on experience with QuickBooks for managing financial transactions.

Education

List your highest degree first, followed by others in reverse chronological order.

Include institution name, degree, and graduation date.

Add relevant coursework, achievements, or certifications for fresher resumes to boost value.

For Experienced Accountants:

Master of Science in Accounting

[University Name], [Location]

Graduated: [Year]

Bachelor of Commerce in Accounting and Finance

[University Name], [Location]

Graduated: [Year]

For Freshers:

Bachelor of Commerce in Accounting

[University Name], [Location]

Graduated: [Year]

Academic Achievement: Secured top 5% rank in Accounting specialization

Relevant Coursework: Financial Reporting, Auditing, Cost Accounting, Taxation

Certifications

List certifications in reverse chronological order (most recent first).

Mention the full name of the certification, issuing organization, and date obtained (or “In Progress” if applicable).

Focus on certifications relevant to accounting and finance to enhance credibility.

For Experienced Accountants:

- Certified Public Accountant (CPA) – [Issuing Body], Obtained: [Year]

- Chartered Financial Analyst (CFA) – Level II Certified, [Year]

- Certified Management Accountant (CMA) – [Issuing Body], [Year]

- Advanced Excel for Financial Professionals – [Institution/Platform], [Year]

For Freshers:

Excel Skills for Business: Advanced – [Platform], [Year]

QuickBooks Online Certification – [Issuing Body], Obtained: [Year]

Fundamentals of Financial Accounting – [Institution/Platform], [Year]

Financial Modeling and Valuation Analyst (FMVA) – In Progress, [Year]

Professional Development

Highlight workshops, training, or additional courses that enhance your accounting expertise.

Include the name of the program, provider, and completion year.

Focus on development areas such as accounting technology, leadership, or specialized accounting practices.

For Experienced Accountants:

- “Advanced Financial Statement Analysis Workshop” – [Institution/Organization], [Year]

- “Leadership in Accounting and Finance” – [Provider], [Year]

- “Tax Reform and Compliance Updates Training” – [Organization], [Year]

- “Data Analytics for Accountants” – [Institution/Platform], [Year]

For Freshers:

“Soft Skills for Finance Professionals” – [Institution], [Year]

“Fundamentals of Accounting and Bookkeeping” – [Institution/Platform], [Year]

“Introduction to Financial Modeling” – [Institution/Platform], [Year]

“Accounting Software Proficiency (QuickBooks, Xero)” – [Training Provider], [Year]

References

Stated: “Available upon request.”

3. Highlight Achievements

Focus on measurable results to demonstrate your value:

- Ensured tax compliance for companies with revenues exceeding [amount].

- Improved financial reporting accuracy by [X%].

- Reduced expenses by [X%] through process improvements.

4. Emphasize Software Proficiency

Many accounting roles require software expertise. Include tools you’re proficient in, such as:

- Analytical tools: Excel (Advanced), Power BI

- Accounting software: QuickBooks, Xero, Tally

- ERP systems: SAP, Oracle

5. Use a Professional Format

- Limit your CV to 1–2 pages.

- Stick to a clean, professional font (e.g., Arial, Calibri).

- Use a simple layout with clear headings and consistent formatting.

6. Proofread

Ensure there are no typos or grammatical errors. Ask a colleague or mentor to review your CV for clarity and impact.

7. Customize Your Cover Letter

While your CV provides an overview, a tailored cover letter explains why you’re the best fit for the specific role.

8. HOBBIES

Include hobbies that showcase transferable skills, such as attention to detail, analytical thinking, or teamwork.

Avoid generic hobbies like “watching TV” unless you can tie them to a relevant skill or professional interest.

If possible, mention hobbies that align with accounting or finance, such as reading business books or solving puzzles.

Example for Accountants:

Participating in trivia games to boost knowledge and quick thinking.

Solving logic puzzles and Sudoku to enhance analytical and problem-solving skills.

Reading financial news and investment strategies to stay updated on industry trends.

Volunteering as a treasurer for local community events to practice budgeting and financial planning.

Practicing mindfulness and yoga to maintain focus and reduce workplace stress.

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor