Resources/Resume-Guide/Claims Adjuster

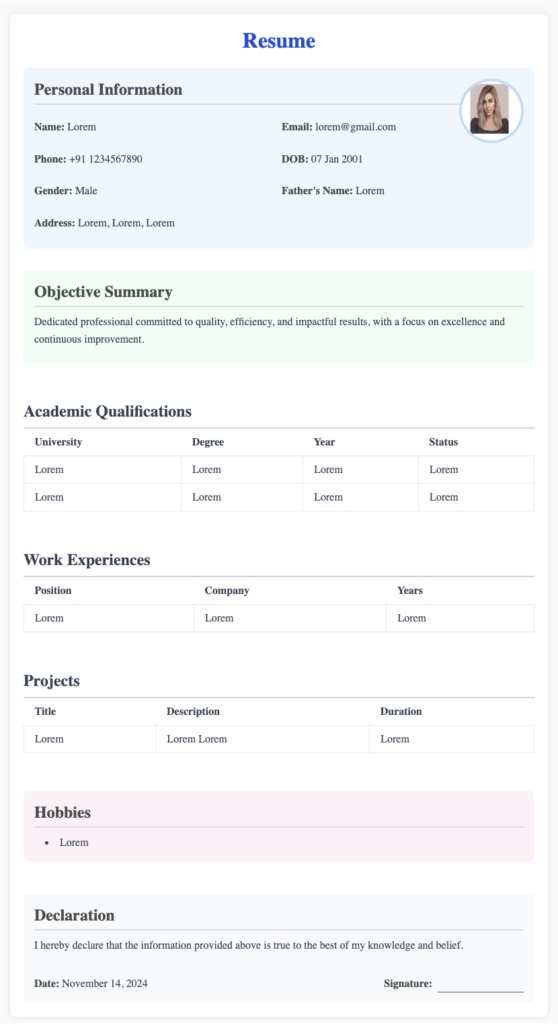

Claims Adjuster CV Guide with Free Resume Template

A well-crafted Claim Adjuster resume demonstrates your expertise in evaluating insurance claims with precision and empathy. Highlight your skills in risk assessment, and negotiation, and your ability to manage complex cases efficiently.

Guidance for a Claims Adjuster Resume

1. Resume Structure

The key focus for a claims adjuster’s resume should be on investigative skills, insurance knowledge, and the ability to resolve claims efficiently. Use the following structure:

Header

- Full Name

- Contact Information: Phone number, professional email address

- Optional: LinkedIn or portfolio link (if relevant)

2. Objective or Summary Statement

This section should highlight your qualifications and career goals:

- Objective (Entry-Level):

“Detail-oriented professional with a bachelor’s degree in risk management and strong problem-solving skills. Seeking an entry-level claims adjuster role to leverage knowledge of insurance policies and commitment to fair and efficient claims resolution.” - Summary (Experienced Professional):

“Licensed claims adjuster with 5+ years of experience investigating, evaluating, and resolving property and casualty claims. Proven track record of reducing resolution times while maintaining a 95% customer satisfaction rate.”

3. Key Skills

Focus on both technical and interpersonal skills:

- Technical Skills:

- Insurance policy analysis

- Claims management software (e.g., Xactimate, Guidewire, CCC One)

- Property damage assessment

- Regulatory compliance

- Interpersonal Skills:

- Negotiation and conflict resolution

- Analytical thinking

- Effective communication

- Time management

4. Professional Experience

List your experience in reverse chronological order, focusing on achievements and measurable outcomes.

Example:

Claims Adjuster | ABC Insurance Company | New York, NY | May 2018 – Present

- Investigated and resolved an average of 50 claims per month, achieving a 95% resolution accuracy rate.

- Reduced claim processing time by 20% by streamlining investigation and reporting processes.

- Negotiated settlements with claimants and third parties, saving the company an average of $10K per case.

Junior Claims Adjuster | XYZ Mutual Insurance | Boston, MA | June 2016 – April 2018

- Supported senior adjusters in evaluating auto and property claims, ensuring compliance with company policies.

- Conducted on-site inspections, documenting damages, and preparing cost estimates.

- Provided clear and empathetic communication to clients, improving satisfaction ratings by 15%.

5. Education

Highlight relevant academic qualifications:

- Degree (e.g., Bachelor’s in Business Administration, Risk Management, or a related field)

- University name and location

- Graduation date

Example:

B.S. in Business Administration | University of Florida | May 2016

6. Certifications

Certifications validate your skills and expertise in the field:

- Essential Certifications:

- State-specific Claims Adjuster License (e.g., Florida 6-20 All-Lines Adjuster License)

- Associate in Claims (AIC) Certification

- Xactimate Certification

- Optional Certifications:

- Chartered Property Casualty Underwriter (CPCU)

- Certified Claims Professional (CCP)

7. Projects or Notable Achievements

Include specific projects or achievements to showcase your impact:

Example:

- Reduced fraudulent claims by implementing a new investigation process that identified inconsistencies in 12% of cases.

- Played a key role in resolving a high-profile natural disaster claim within 30 days, earning commendation from senior management.

8. Awards & Recognitions

List accolades that highlight your performance:

- “Claims Specialist of the Year,” ABC Insurance, 2022

- Recognized for maintaining the highest resolution accuracy in the department (2021)

9. Professional Memberships

Showcase involvement in industry organizations:

- National Association of Independent Insurance Adjusters (NAIIA)

- Chartered Property Casualty Underwriter Society (CPCU)

10. Example Claims Adjuster Resume

Jane Doe

[Phone Number] | [Email Address] | [LinkedIn Profile]

Objective

Dedicated claims adjuster with 4+ years of experience resolving property and casualty claims. Skilled in investigative techniques, policy analysis, and customer service, seeking to bring expertise to [Company Name] to ensure efficient and fair claims settlements.

Key Skills

- Claims software proficiency (Xactimate, Guidewire)

- Negotiation and conflict resolution

- Policy analysis and coverage evaluation

- Regulatory compliance knowledge

Professional Experience

Claims Adjuster | ABC Insurance | Dallas, TX | June 2019 – Present

- Managed 50+ claims monthly, including property damage and liability claims, with a resolution rate of 98%.

- Conducted thorough investigations, including interviews and on-site inspections, reducing fraudulent claims by 15%.

- Negotiated settlements that saved the company $150K annually.

Claims Analyst | XYZ Mutual | Austin, TX | May 2016 – May 2019

- Reviewed and processed claims documentation, ensuring adherence to state and federal regulations.

- Assisted in the resolution of disputes, reducing customer complaints by 25%.

- Trained new hires on claims software and compliance protocols.

Education

B.S. in Risk Management | University of Texas | May 2016

Certifications

- Texas All-Lines Adjuster License (#123456)

- Associate in Claims (AIC) Certification

- Xactimate Level 2 Certified

Awards

Recognized for exceptional customer service, 2021

“Top Claims Adjuster,” ABC Insurance, 2022

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor