Resources/Resume-Guide/Financial Advisor

Financial Advisor CV Guide with Free Resume Template

A financial advisor’s job is to understand a client’s financial goals and then assist in creating strategies to achieve them. To do so, financial advisors must be able to understand, and analyze, market trends and provide sound financial advice based on various financial indicators.

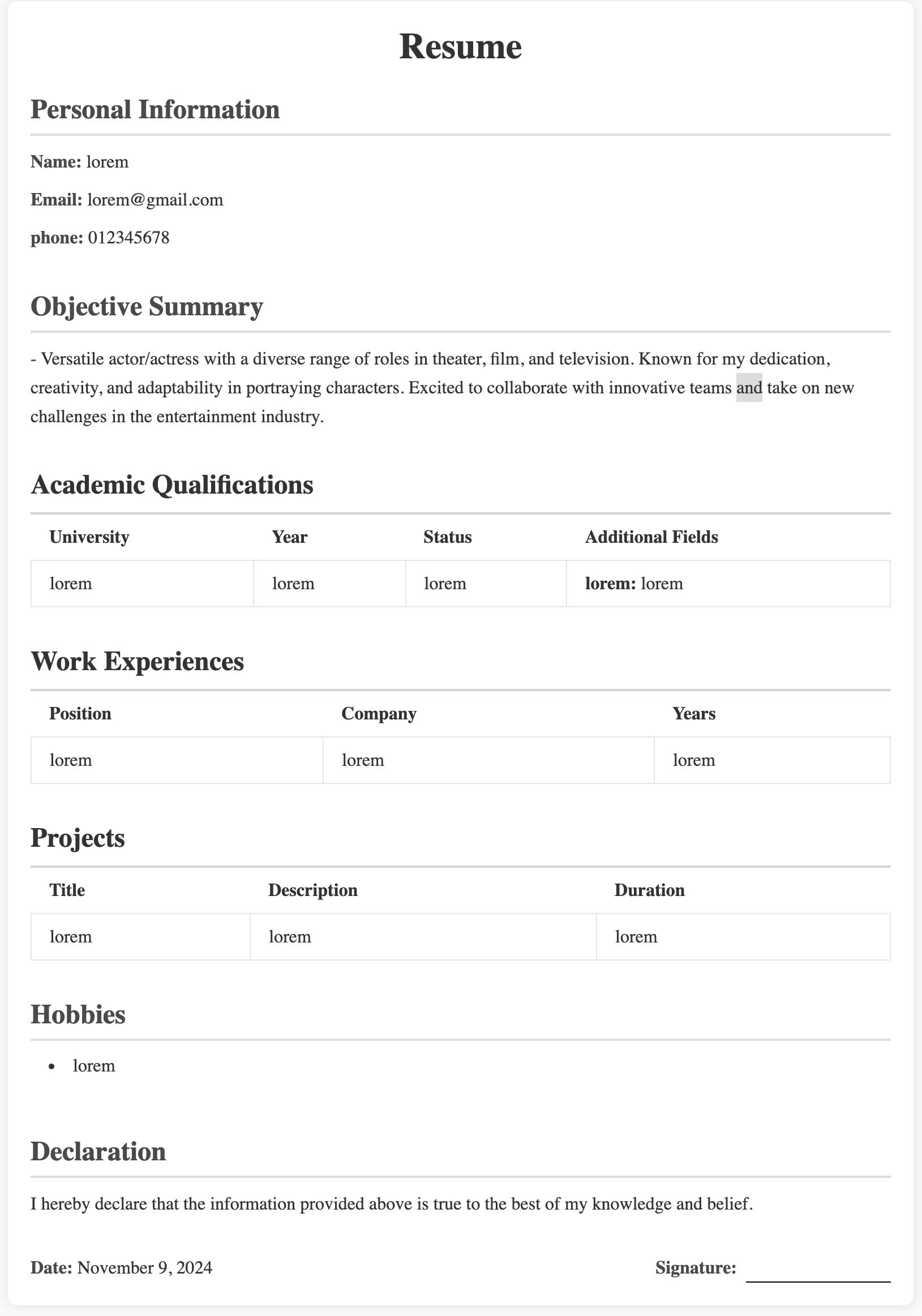

1. Contact Information

Feature your name and title in a visually distinct way to create an immediate impression.

Example:

- Name: Johnathan Equity

- Professional Title: Certified Financial Planner (CFP) | Wealth Strategist

- Contact Info:

- Phone: (555) 555-5555

- Email: johnathan.equity@example.com

- LinkedIn: linkedin.com/in/johnathanequity

- Personal Website: johnathanequity.com (optional)

2. Personal Branding Statement

Instead of a generic summary, craft a Personal Branding Statement that reflects your unique approach to financial advising.

Example:

“Empowering clients to achieve financial independence through bespoke strategies that merge traditional wealth management with modern technology. A data-driven financial advisor with a passion for building meaningful relationships and fostering long-term success.”

3. Unique Key Competencies Section

Include a “signature touch” by adding skills with creative yet professional labels.

Key Competencies:

- Portfolio Architect: Expertise in asset allocation and diversification tailored to client goals.

- Strategic Visionary: Long-term financial planning with a focus on intergenerational wealth transfer.

- Data-Driven Advisor: Leveraging financial modeling tools like Bloomberg Terminal, Excel VBA, and Power BI.

- Compliance Navigator: Ensures adherence to SEC and FINRA regulations with a deep understanding of fiduciary duties.

- Relationship Builder: Fosters trust through regular client touchpoints and transparency.

4. Professional Experience

Focus on the unique value you added to each role with quantitative achievements and client-centered outcomes.

Example:

Senior Financial Advisor

Legacy Wealth Partners | Chicago, IL | Jan 2018 – Present

- Designed customized financial roadmaps for over 150 high-net-worth clients, leading to a 30% average portfolio growth over 3 years.

- Increased client retention by 40% through the implementation of quarterly wealth workshops and one-on-one coaching.

- Identified and mitigated risks in client portfolios, achieving a 20% reduction in exposure to volatile markets.

- Introduced ESG investment strategies, attracting environmentally conscious investors and growing assets under management (AUM) by $15M.

Financial Analyst

Pinnacle Investments | New York, NY | Jun 2015 – Dec 2017

- Analyzed market trends and delivered actionable insights, leading to a 25% increase in fund performance for key clients.

- Collaborated with cross-functional teams to streamline data analysis, reducing report generation time by 50%.

- Authored a client education series on market volatility, resulting in a 15% uptick in investor confidence.

5. Certifications & Education

Present certifications prominently, as they are vital in financial advising.

Certifications:

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- FINRA Series 7, 63, and 65 Licensed

Education:

Bachelor of Science in Finance

Wharton School, University of Pennsylvania | Graduated: May 2015

6. Awards & Recognition

Showcase your industry recognition to establish credibility.

Example:

- Winner, Top Financial Advisor Under 40 – Financial Planning Association (2022)

- Recognized as Client Champion by Wealth Management Today (2021)

7. Unique Sections to Differentiate Your Resume

Client Testimonials:

Add brief quotes from satisfied clients or supervisors (with permission).

“Johnathan helped me grow my portfolio while aligning with my values. His dedication to my financial well-being is unmatched.” – A.K., Long-term Client

Professional Philosophy/Unique Value Proposition:

Add a small section describing your distinctive approach to financial advising.

Example:

“I believe in empowering clients through education, combining actionable insights with technology to demystify wealth-building.”

Community Engagement:

Show involvement in financial literacy programs, nonprofit organizations, or mentoring roles.

Example:

- Founder, Financial Literacy for All – Provided free workshops to underserved communities.

- Volunteer, Junior Achievement USA – Educated high school students on budgeting and investing basics.

Technological Edge:

Highlight your proficiency with cutting-edge tools.

- Financial Planning Software: eMoney Advisor, MoneyGuidePro

- CRM Platforms: Salesforce, HubSpot

- Market Analysis Tools: Bloomberg Terminal, Morningstar

8. Hobbies/Interests (Optional)

Include interests that reflect your personality and align with the financial advisor profession (e.g., chess, data visualization, or entrepreneurship).

Example:

- Personal Finance Blogger: Writes articles on demystifying retirement planning for millennials.

- Stock Market Enthusiast: Regularly hosts market analysis webinars for local investor groups.

9. Formatting Tips

File Format: Save as a PDF for consistency.

Design: Use clean lines and subtle color accents to draw attention to key sections without being flashy.

Font: Choose professional fonts like Calibri, Lato, or Georgia (sizes 10–12).

Sections: Use headings and subheadings for easy navigation.

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor