Resources/Resume-Guide/Stockbroker

Stockbroker

Resume Guidance

A stockbroker is a financial professional who executes orders in the market on behalf of clients. A stockbroker may also be known as a registered representative (RR) or an investment advisor.

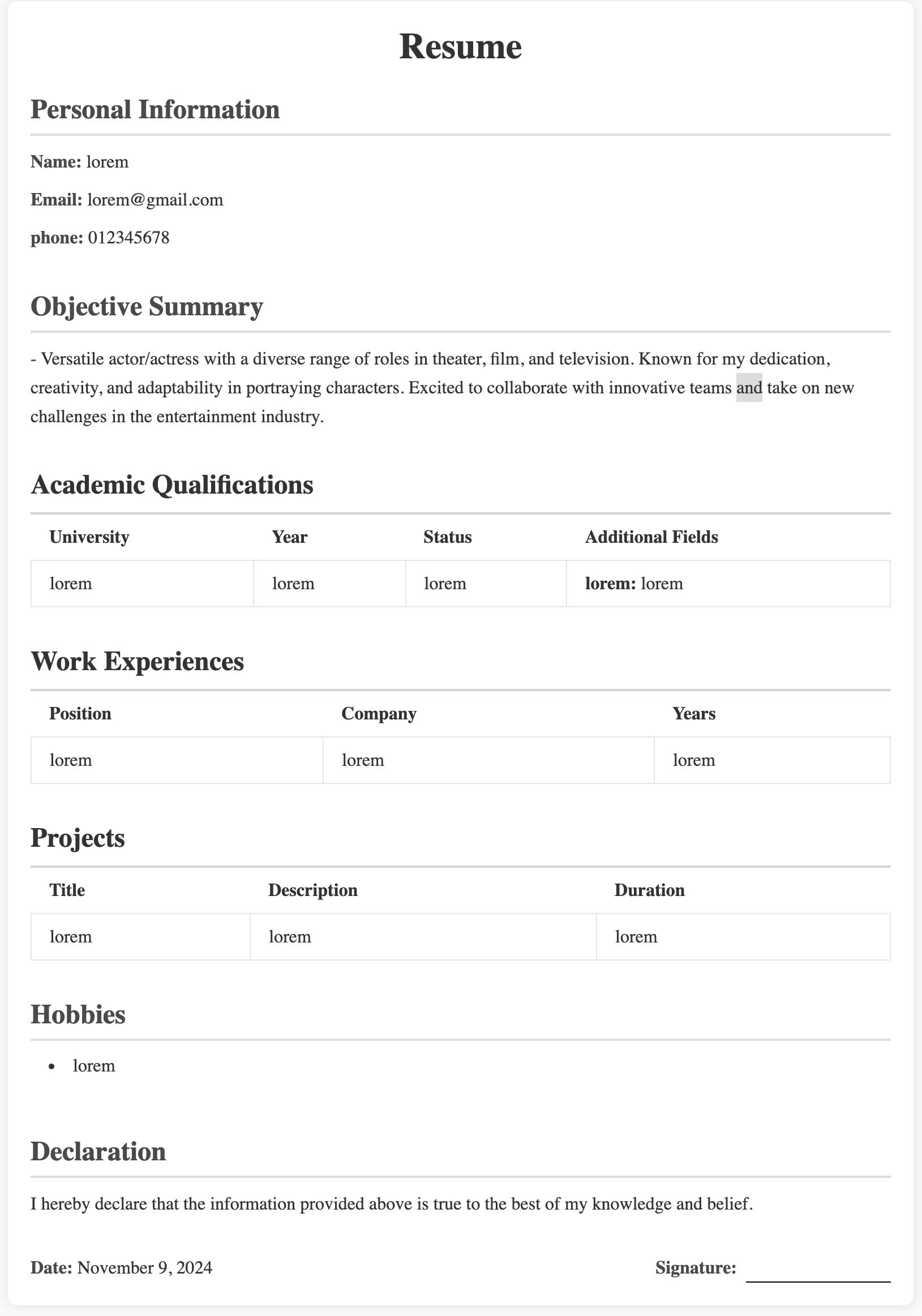

1. Format Your Resume

- Header: Include your full name, phone number, email, and LinkedIn profile (optional).

- Sections: Organize your resume into clear sections: Professional Summary, Skills, Experience, Education, Certifications, and Additional Sections (optional).

2. Write a Strong Professional Summary

Your professional summary should highlight your experience in the financial industry, areas of expertise, and any specialized skills. Focus on your ability to build client relationships, manage portfolios, and execute trades effectively.

Example:

A dynamic and results-driven stockbroker with 7+ years of experience helping clients manage investments and navigate financial markets. Proven success in executing buy and sell orders, analyzing market trends, and providing strategic financial advice. Skilled in building strong client relationships and maintaining compliance with financial regulations.

3. Highlight Relevant Skills

Include both hard and soft skills relevant to stockbroking, such as financial analysis, market knowledge, client relations, and regulatory adherence.

Example:

- Financial Analysis: Stock valuation, portfolio management, market research, and financial forecasting.

- Trading Platforms: Proficient in using platforms like Bloomberg Terminal, E*TRADE, and TD Ameritrade.

- Regulatory Knowledge: Understanding of SEC regulations, FINRA rules, and compliance protocols.

- Client Relations: Strong communication, client consultations, and relationship building.

- Sales Skills: Upselling financial products, closing deals, and generating leads.

- Risk Management: Risk assessment, asset allocation, and managing volatility.

4. Detail Your Work Experience

Describe your roles, focusing on how you helped clients succeed and contributed to the firm’s growth. Use action verbs and quantify your achievements where possible.

Example:

Stockbroker

ABC Financial Services | Jan 2020 – Present

- Managed portfolios for 50+ high-net-worth clients, with an average portfolio growth of 12% annually.

- Executed buy and sell orders for stocks, bonds, and mutual funds, ensuring timely and profitable transactions.

- Provided tailored investment strategies based on client goals, risk tolerance, and market conditions.

- Conducted in-depth market analysis, leading to a 15% increase in client retention.

- Developed new business by leveraging existing client relationships and generating 25+ new leads per quarter.

Junior Stockbroker

XYZ Investments | June 2015 – Dec 2019

- Assisted senior brokers with market research, client portfolios, and trade execution.

- Prepared and delivered detailed reports on market trends, investment opportunities, and financial products.

- Built relationships with potential clients, contributing to a 10% growth in firm revenue.

- Stayed current with market fluctuations, adjusting clients’ portfolios to mitigate risk and seize opportunities.

5. Education

List your degree(s), relevant coursework, or honors. If you have additional certifications or licenses, mention them here as well.

Example:

- Bachelor of Science in Finance | XYZ University | Graduated: 2015

- Relevant Coursework: Investment Analysis, Financial Accounting, Corporate Finance

- MBA in Finance (optional)

6. Certifications and Licenses

Stockbrokers often need specific certifications and licenses. Make sure to include all that apply to your career.

Example:

- Series 7 License | FINRA (Financial Industry Regulatory Authority)

- Series 63 License | FINRA

- Series 66 License (if applicable)

- Certified Financial Planner (CFP) (optional)

- Series 3 License (for commodities trading) (if applicable)

7. Additional Sections (Optional)

- Awards and Achievements: If you’ve received recognition for sales performance or investment success, include it here.

- Professional Development: Mention any relevant courses, workshops, or conferences.

- Languages: If you speak multiple languages, this can be helpful in global markets.

- Volunteer Work: Include volunteer roles where you used financial or advisory skills.

8. Tips for Success

Proofread: Make sure your resume is free of errors. Typos or formatting mistakes can undermine your professionalism.cific ambulance service or location?

Tailor Your Resume: Customize your resume for each position by emphasizing the skills and experience mentioned in the job description.

Quantify Your Success: Whenever possible, include numbers to demonstrate the impact you made (e.g., “Increased client portfolio value by 20% in one year”).

Professional Formatting: Use a clean, easy-to-read layout with consistent fonts and spacing.

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor