Resources/Resume-Guide/Tax Preparer

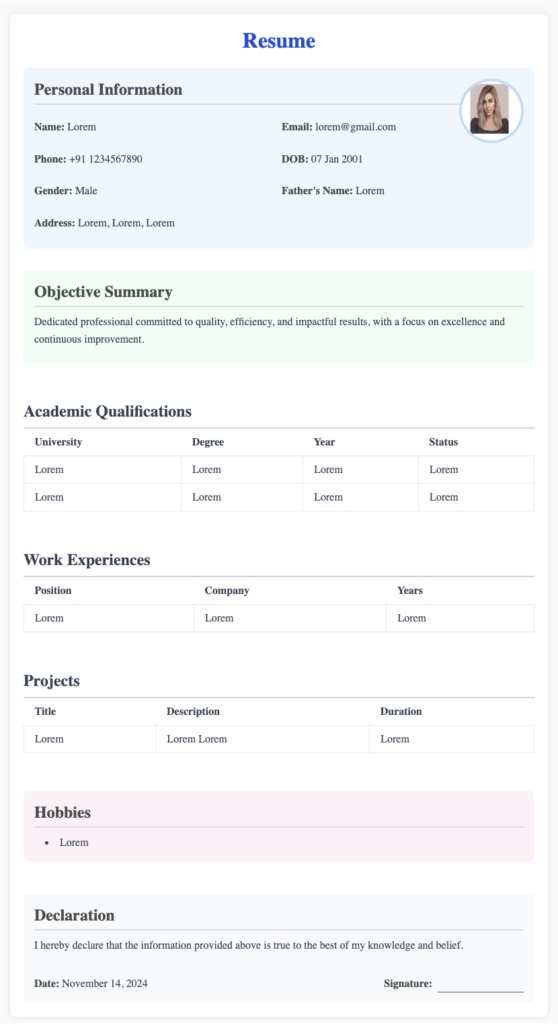

Tax Preparer Resume Guidance

A Tax Preparer is a professional who helps clients file taxes. They meet with these clients to review financial records and ensure all their information on tax forms is accurate.

1. Contact Information

Include your personal details prominently at the top:

- Full Name

- Phone Number

- Email Address

- Location (City, State)

- LinkedIn Profile (optional)

- Portfolio or Website (if applicable, for professional branding or showcasing certifications)

2. Professional Summary

Write a concise summary emphasizing your skills, experience, and accomplishments as a tax preparer.

Example:

“Detail-oriented and client-focused Tax Preparer with over 5 years of experience in preparing individual and business tax returns. Proficient in utilizing tax software, ensuring compliance with federal, state, and local tax regulations, and maximizing deductions and credits for clients. Known for maintaining strict confidentiality and providing excellent customer service to resolve tax issues efficiently. Dedicated to staying updated with tax law changes to deliver accurate and timely filing solutions.”

3. Key Skills

Highlight the technical and interpersonal skills that make you a standout tax preparer.

Technical Skills:

- Tax Preparation and Filing (Individual, Corporate, Estate, Trust)

- Knowledge of IRS Regulations and Tax Codes

- Financial Data Analysis

- Tax Software Proficiency (e.g., TurboTax, ProConnect, Drake, TaxSlayer Pro)

- Bookkeeping and Payroll Processing

- Tax Planning and Advisory Services

- Audit Support and Representation

- Recordkeeping and Documentation

- Researching Tax Laws and Compliance

Soft Skills:

- Attention to Detail

- Problem-solving and Critical Thinking

- Client Relationship Management

- Communication and Interpersonal Skills

- Time Management and Organizational Skills

4. Professional Experience

List your work history in reverse chronological order. Focus on accomplishments, responsibilities, and results that showcase your expertise in tax preparation and client service.

Example:

Senior Tax Preparer

XYZ Tax Solutions | Los Angeles, CA | January 2019 – Present

- Prepared and filed over 500 tax returns annually for individuals, small businesses, and non-profits, maintaining a 98% accuracy rate.

- Provided strategic tax planning advice to clients, reducing liabilities by an average of 15%.

- Conducted detailed audits of financial records to ensure compliance with IRS regulations.

- Resolved client inquiries regarding tax issues, including discrepancies and penalties.

- Trained and supervised a team of 4 junior preparers, improving efficiency by 20%.

Tax Preparer

ABC Tax Services | Chicago, IL | May 2016 – December 2018

- Assisted clients with the preparation of federal, state, and local tax returns, ensuring adherence to all applicable laws.

- Reviewed financial documents such as income statements and expense reports to identify eligible deductions and credits.

- Maintained meticulous records of client interactions and filings for future reference.

- Utilized software like Drake Tax to streamline the preparation process, reducing average turnaround time by 30%.

5. Education

Include your educational background, especially if it’s relevant to accounting, finance, or tax law.

Example:

Bachelor of Science in Accounting

University of Texas | Graduated: May 2015

6. Certifications and Licenses

Certifications can set you apart as a qualified tax preparer. List them prominently.

Example:

- IRS Enrolled Agent (EA)

- Certified Public Accountant (CPA) (if applicable)

- Annual Filing Season Program (AFSP) – IRS

- QuickBooks Certified ProAdvisor

- Tax Law Specialist Certification (if applicable)

7. Achievements and Projects

Showcase specific accomplishments that demonstrate your ability to deliver results for clients.

Example:

- Saved a client $50,000 in tax liabilities by identifying overlooked deductions and restructuring their financial reporting.

- Spearheaded a new document management system that improved tax record retrieval time by 40%.

- Successfully represented 10+ clients in IRS audits, achieving favorable outcomes in all cases.

8. Technical Tools and Software

Include a section for software and tools you’re proficient in to demonstrate your technical expertise.

Example:

- Tax Software: ProConnect, Drake Tax, TurboTax, TaxAct

- Accounting Software: QuickBooks, Xero, Sage

- Office Tools: Microsoft Excel, Google Sheets, Word

- Research Tools: IRS e-Services, CCH IntelliConnect, TaxSlayer Pro

9. Volunteer Experience (Optional)

If you’ve provided tax preparation services as a volunteer, include them to demonstrate your community involvement and dedication to the field.

Example:

Volunteer Tax Preparer

VITA Program (Volunteer Income Tax Assistance) | 2015 – 2017

- Assisted low-income families with tax preparation, filing over 200 accurate returns annually.

- Educated taxpayers on maximizing credits like EITC and Child Tax Credits.

10. Additional Sections

Languages

If you’re bilingual or multilingual, highlight this skill, as it’s valuable when working with diverse clients.

Example:

- Fluent in English and Spanish

Hobbies and Interests (Optional)

Include only if they’re relevant or provide insight into your professional approach.

Example:

- Passionate about teaching financial literacy to underserved communities.

11. Formatting Tips

- Length: Keep your resume to one page unless you have extensive experience.

- Font: Use professional fonts like Arial, Calibri, or Times New Roman (size 10–12).

- Design: Use a clean, professional layout with clear headings and bullet points.

- File Format: Save as a PDF to maintain formatting when sharing.

12. Customize for the Job Posting

Tailor your resume to match the specific requirements of the job posting. Highlight the skills, certifications, or experiences most relevant to the role.

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor