Resources/Reaume Sample/Banker

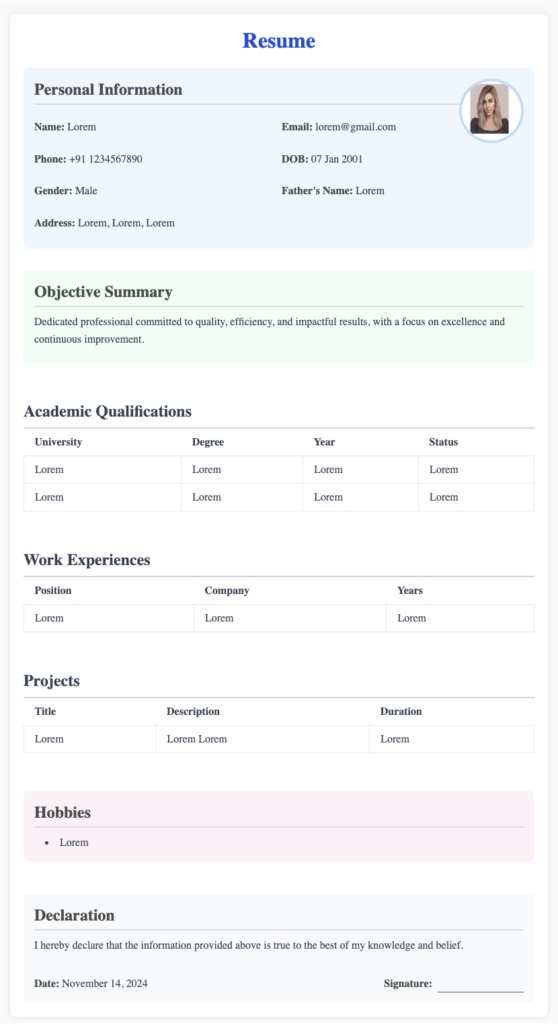

Banker CV Guide with Free Resume Template

A baker’s CV, or Curriculum Vitae, is a document that details a baker’s skills, experience, and training to potential employers. It’s an important part of a job application and a chance to make a good first impression on recruiters.

1. Contact Information

Include your full name, phone number, email address, and location (city, state). Optionally, include a link to your LinkedIn profile or a professional portfolio.

Example:

Name: John Doe

Email: john.doe@example.com

Phone: (123) 456-7890

Location: New York, NY

LinkedIn: linkedin.com/in/johndoe

2. Professional Summary

Write a concise summary (2–4 sentences) that highlights your experience, skills, and career goals. Tailor it to the banking role you’re applying for.

Example:

Experienced and results-driven banking professional with 8+ years in retail and corporate banking. Skilled in relationship management, financial analysis, and achieving sales targets. Proven ability to deliver personalized financial solutions while ensuring regulatory compliance. Seeking to leverage expertise in a leadership role at a growth-oriented financial institution.

3. Key Skills

List your most relevant skills tailored to the banking role. Use bullet points for clarity.

Examples:

- Financial advising and investment strategies

- Customer relationship management (CRM)

- Loan processing and underwriting

- Regulatory compliance (AML, KYC)

- Data analysis and financial modeling

- Sales and cross-selling banking products

- Cash handling and transaction management

4. Work Experience

Detail your relevant work history in reverse chronological order. For each position, include your job title, company name, dates of employment, and key responsibilities or achievements.

Example:

Senior Relationship Banker – ABC Bank, New York, NY (Jan 2019 – Present)

- Manage a portfolio of 150+ high-net-worth clients, providing tailored financial solutions.

- Achieved 120% of quarterly sales targets by cross-selling banking and investment products.

- Conduct detailed financial analyses to assess clients’ creditworthiness for loans and mortgages.

- Ensure compliance with AML and KYC regulations in all client interactions.

Bank Teller – XYZ Credit Union, Brooklyn, NY (May 2016 – Dec 2018)

- Processed an average of 200 transactions daily with 100% accuracy.

- Provided exceptional customer service, addressing inquiries and resolving account issues.

- Promoted to Relationship Banker within 18 months due to outstanding performance.

5. Education

Include your academic qualifications, starting with the most recent.

Example:

Bachelor of Science in Finance – University of Pennsylvania, Philadelphia, PA (2015)

6. Certifications and Training

Highlight certifications relevant to banking and finance.

Example:

- Certified Financial Planner (CFP) – CFP Board

- Anti-Money Laundering (AML) Certification – ACAMS

- Series 6 and 63 Licenses – FINRA

7. Achievements and Awards (Optional)

List any notable awards or recognitions that emphasize your skills or performance.

Example:

- “Top Sales Performer” – ABC Bank, 2021

- Employee of the Month – XYZ Credit Union, June 2018

8. Additional Information (Optional)

Include any relevant details, such as language proficiency, technical skills, or volunteer work.

Example:

Languages: Fluent in Spanish and English

Technical Skills: Proficient in MS Excel, Salesforce CRM, and financial software (QuickBooks, Bloomberg Terminal)

Tips for an Effective Banker Resume

- Tailor for the Role: Customize your resume to match the job description. Emphasize relevant skills and experiences.

- Quantify Achievements: Use numbers to demonstrate impact (e.g., “Increased customer retention by 20%”).

- Use Professional Language: Avoid jargon but maintain a professional tone.

- Keep It Concise: Limit your resume to 1–2 pages.

- Proofread: Ensure your resume is free of errors to reflect attention to detail.

If you need assistance with tailoring your resume for a specific banking position or optimizing its format, let me know!

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor