Resources/Resume-Guide/Investment Banker

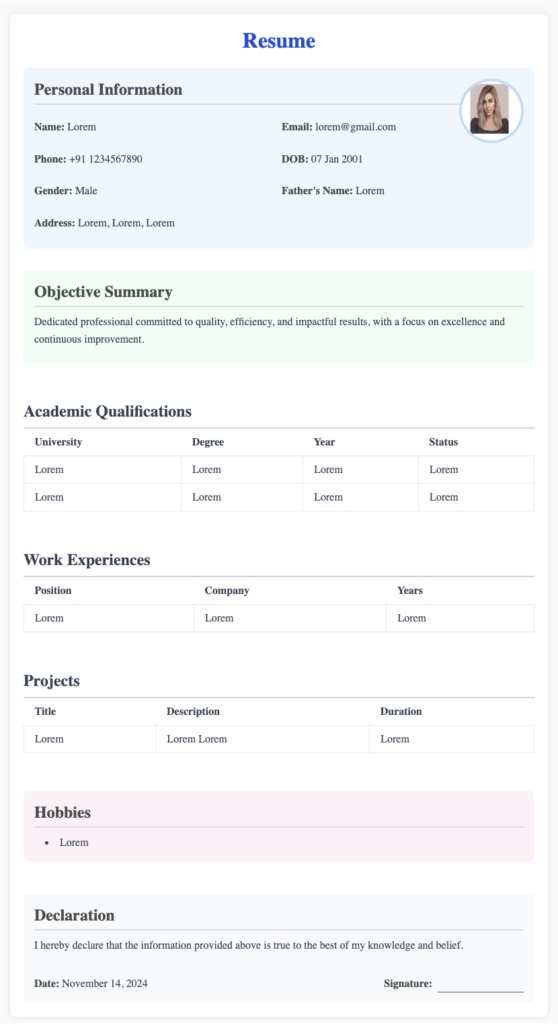

Investment Banker CV Guide with Free Resume Template

A well-crafted Investment Banker resume demonstrates a keen ability to navigate complex financial landscapes and drive strategic growth. Highlight your expertise in financial modeling, mergers and acquisitions, and capital raising, as these are pivotal skills in the industry.

1. Resume Layout and Formatting

- Font: Use professional fonts like Arial, Calibri, or Times New Roman. Font size 10–12 for body text.

- Length: Keep it to 1 page. For seasoned bankers, a 2-page resume is acceptable if needed to showcase extensive deal experience.

- Sections: Contact Information, Professional Summary, Key Skills, Work Experience, Education, Certifications, and Optional Sections (e.g., Deal Experience, Leadership Activities, or Volunteer Work).

2. Contact Information

Place this at the top of your resume:

- Full Name

- Phone Number

- Professional Email Address

- LinkedIn Profile (Optional but recommended)

- Portfolio or Deal Sheet Link (If applicable for experienced bankers)

3. Professional Summary

Write a concise, 2–3 sentence summary highlighting your experience, skills, and career goals.

Example:

“Highly driven Investment Banker with 5+ years of experience in M&A advisory, capital raising, and financial modeling. Successfully managed transactions valued at over $1B across healthcare and technology sectors. Adept at delivering client-focused solutions and thriving in fast-paced environments.”

4. Key Skills

Highlight technical and interpersonal skills essential for investment banking.

Examples of Key Skills:

Technical Skills:

- Financial Modeling and Valuation (DCF, LBO, Comparable Analysis)

- Mergers & Acquisitions (M&A)

- Initial Public Offerings (IPOs)

- Leveraged Buyouts (LBOs)

- PitchBook Creation

- Excel, PowerPoint, Bloomberg Terminal

Soft Skills:

- Strategic Communication

- Client Relationship Management

- Leadership and Team Collaboration

- Attention to Detail

- Negotiation Skills

- Analytical Problem-Solving

5. Professional Experience

This section is the heart of your resume. Use reverse chronological order, quantify achievements, and focus on deal-related experiences.

Example:

Investment Banking Associate

[Company Name], [City, State]

Month/Year – Present

- Advised on $500M+ in M&A transactions in the healthcare and consumer goods sectors.

- Built detailed financial models, including DCF and LBO analyses, to evaluate strategic opportunities.

- Developed and presented client pitch books, securing mandates for two high-profile deals.

- Collaborated with legal and accounting teams to perform due diligence on acquisition targets.

Investment Banking Analyst

[Company Name], [City, State]

Month/Year – Month/Year

- Supported 10+ transactions, including IPOs, private placements, and M&A.

- Conducted industry research and prepared detailed market analysis reports.

- Produced client-ready presentations, improving deal-winning proposals by 20%.

- Automated data processing tasks using Excel macros, saving 10+ hours per week for the team.

6. Deal Sheet (Optional for Experienced Bankers)

If you have extensive deal experience, include a separate Deal Sheet or Transaction Highlights section.

Example: Select Transactions:

- $250M Acquisition of [Company Name]: Conducted valuation analysis and led due diligence for the acquirer.

- $100M IPO for [Company Name]: Prepared financial forecasts and collaborated with underwriters.

- $500M Leveraged Buyout: Built comprehensive LBO models to support private equity financing.

7. Education

Highlight your academic achievements, especially if you have relevant degrees or coursework.

Example:

Bachelor of Science in Finance

[University Name], [City, State]

Graduated: Month/Year

- GPA: 3.8/4.0 (if above 3.5)

- Relevant Coursework: Corporate Finance, Financial Modeling, M&A, Accounting

8. Certifications

Certifications demonstrate expertise and commitment to professional development.

Examples of Relevant Certifications:

- CFA Charterholder (or CFA Level I/II/III Candidate)

- FINRA Licenses (e.g., Series 7, Series 63)

- Financial Modeling & Valuation Analyst (FMVA)

- Wall Street Prep or Breaking Into Wall Street Training

9. Optional Sections

Leadership Activities

Highlight extracurricular roles that demonstrate leadership or teamwork.

Example:

- Vice President, Finance Club: Organized guest speaker events featuring industry leaders.

- Case Competition Winner: Led a team to develop a winning LBO strategy in a national competition.

Volunteer Work

If relevant, showcase volunteer work in financial education or community service.

Example:

- Financial Literacy Workshop Volunteer: Taught budgeting and investment basics to underprivileged youth.

Awards and Achievements

Include relevant accolades, such as academic awards or professional recognition.

Example:

- “Top Analyst Award” — [Bank Name], [Year]

- Dean’s List — [University Name], [Years]

10. References

Do not include references directly on your resume. Instead, state “References available upon request.”

Key Tips for Investment Banking Resumes

Proofread: Attention to detail is critical in investment banking—ensure your resume is error-free.

Tailor to the Job: Customize your resume for each role, emphasizing skills and experience that match the job description.

Use Metrics: Quantify accomplishments (e.g., “supported $1B in transactions” or “improved efficiency by 15%”).

Focus on Results: Highlight the impact of your work on transactions, client outcomes, or team efficiency.

Keep It Concise: Prioritize clarity and remove irrelevant details.

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor