Resources/Resume-Guide/Loan Officer

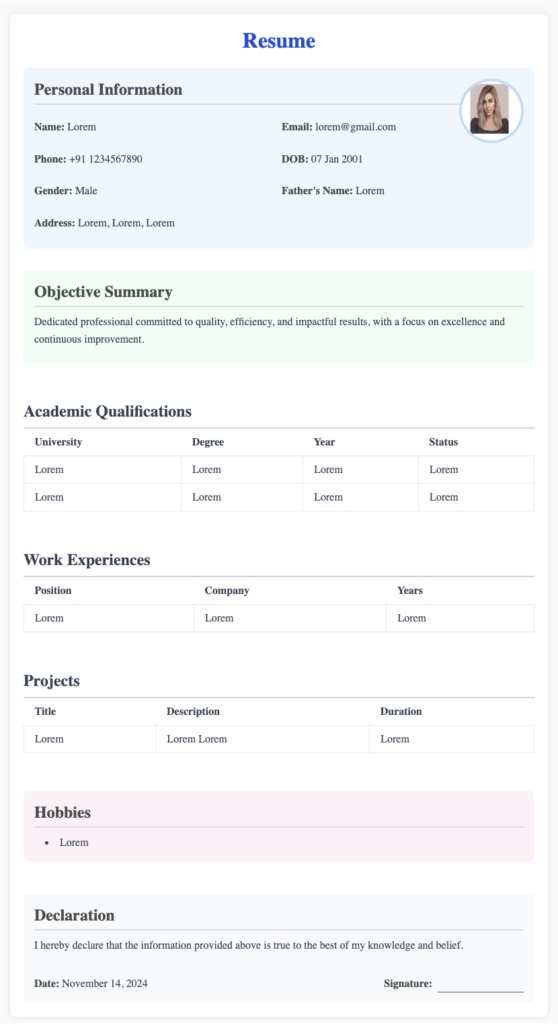

Loan Officer Resume Guidance

A well-crafted Loan Officer resume demonstrates your ability to navigate complex financial landscapes and build strong client relationships. Highlight your expertise in credit analysis, risk assessment, and loan origination to showcase your comprehensive understanding of the lending process.

1. Contact Information

At the top of the resume, include:

- Full Name

- Professional Email Address (e.g., janedoe@email.com)

- Phone Number

- City, State (Full address is optional)

- LinkedIn Profile (to showcase professional connections and recommendations)

2. Professional Summary

Write a concise 2-3 sentence summary that highlights your experience, skills, and professional goals. Tailor it to the job you’re applying for.

Example:

“Results-driven Loan Officer with 5+ years of experience originating and managing mortgage, commercial, and consumer loans. Skilled in analyzing financial data, assessing creditworthiness, and building strong client relationships to exceed sales goals. Proven track record of achieving 15% year-over-year loan portfolio growth while ensuring compliance with lending regulations.”

3. Key Skills

Highlight technical, analytical, and interpersonal skills that match the job description.

Examples:

- Loan Origination & Processing

- Credit Analysis & Risk Assessment

- Mortgage & Commercial Lending

- Customer Relationship Management (CRM)

- Financial Documentation Review

- Regulatory Compliance (FHA, VA, and conventional loans)

- Sales & Business Development

- Underwriting Principles

- Strong Negotiation Skills

- Proficiency with Loan Software (e.g., Encompass, Calyx, LOS systems)

4. Professional Experience

List your work experience in reverse chronological order. Focus on achievements and contributions using action verbs, and quantify results whenever possible.

Example:

Loan Officer

ABC Bank, New York, NY | June 2020 – Present

- Originated and closed over $15 million in mortgage loans annually, surpassing quarterly sales targets by 20%.

- Assisted clients in identifying suitable loan products (FHA, VA, USDA, and conventional) based on financial needs and creditworthiness.

- Conducted thorough financial analyses, including income verification, credit assessment, and risk evaluation, reducing default rates by 10%.

- Streamlined the loan application process, reducing approval turnaround time by 15% and improving client satisfaction scores.

- Cultivated relationships with realtors, builders, and financial advisors, increasing referral business by 25%.

Junior Loan Officer

XYZ Financial Services, Miami, FL | January 2017 – May 2020

- Assisted senior loan officers in processing loan applications, ensuring accurate documentation and timely submission.

- Conducted credit checks and compiled borrower financial data to assess eligibility for various loan products.

- Supported customer inquiries and guided clients through loan options, contributing to a 90% loan approval success rate.

- Collaborated with underwriting teams to resolve documentation issues and streamline loan closings.

5. Education

Include relevant degrees and certifications.

Example:

- Bachelor of Science in Finance, University of Florida, Gainesville, FL | 2016

6. Certifications

Showcase any professional certifications that demonstrate credibility and expertise.

Examples:

- NMLS License (Nationwide Multistate Licensing System)

- Certified Mortgage Loan Officer

- Commercial Lending Certification

- FHA Direct Endorsement Certification

7. Technical Proficiencies

Highlight software, systems, and tools you’re skilled in that are relevant to loan processing.

Examples:

- Loan Origination Software: Encompass, Calyx Point, BytePro

- CRM Tools: Salesforce, HubSpot

- Financial Analysis Tools: Excel (Advanced), QuickBooks

- Credit Reporting Systems: Equifax, Experian, TransUnion

8. Additional Sections (Optional)

- Awards & Recognition: Include achievements like “Top Loan Officer Award 2022 – Closed $20M in Loans.”

- Professional Memberships: Member, Mortgage Bankers Association (MBA)

- Languages: Bilingual skills can be valuable, e.g., “Fluent in Spanish and English.”

Tips for a Strong Loan Officer Resume

Keep It Clean and Professional: Use clear formatting, and bullet points, and keep it to 1-2 pages.

Tailor Your Resume: Incorporate keywords from the job description to align with the role.

Quantify Achievements: Use metrics to demonstrate success (e.g., “Closed $15M annually,” “Reduced processing times by 20%”).

Show Compliance Knowledge: Highlight understanding of lending regulations and industry standards.

Highlight Sales Acumen: Showcase your ability to generate leads, close deals, and build client relationships.

Recent Categories

- General

- Accountant

- Actor/Actress

- Administrator

- Advertising Executive

- Aerospace Engineer

- Agricultural Engineer

- Air Traffic Controller

- Aircraft Mechanic

- Ambulance Driver

- Animator

- Architect

- Artist

- Astronomer

- Athlete

- Attorney/Lawyer

- Audiologist

- Author

- Baker

- Banker

- Barista

- Bartender

- Biologist

- Biomedical Engineer

- Bookkeeper

- Brand Manager

- Bus Driver

- Business Analyst

- Butcher

- Carpenter

- Chef

- Chemical Engineer

- Chemist

- Chiropractor

- Civil Engineer

- Claims Adjuster

- Clinical Psychologist

- Coach

- Computer Engineer

- Computer Operator

- Copywriter

- Cosmetologist

- Costume Designer

- Court Reporter

- Dancer

- Dental Assistant

- Dentist

- Dermatologist

- Detective

- Dietitian

- Director

- Dispatcher

- DJ

- Doctor

- Economist

- Editor

- Electrician

- EMT

- Engineer

- Environmental Scientist

- Event Planner

- Executive Assistant

- Fashion Designer

- Film Director

- Financial Advisor

- Firefighter

- Fitness Trainer

- Flight Attendant

- Florist

- Forensic Scientist

- Game Developer

- Gardener

- Geologist

- Graphic Designer

- Hair Stylist

- Handyman

- Health Educator

- Home Inspector

- Hotel Manager

- HR Manager

- Illustrator

- Industrial Designer

- Information Security Analyst

- Insurance Agent

- Interior Designer

- Interpreter

- Investment Banker

- IT Manager

- Journalist

- Judge

- Laboratory Technician

- Landscaper

- Librarian

- Linguist

- Loan Officer

- Lobbyist

- Locksmith

- Logistician

- Makeup Artist

- Manager

- Marine Biologist

- Market Research Analyst

- Massage Therapist

- Mathematician

- Mechanic

- Medical Assistant

- Medical Biller

- Medical Coder

- Medical Interpreter

- Medical Transcriptionist

- Meteorologist

- Microbiologist

- Model

- Mortician

- Musician

- Nanny

- Network Administrator

- Nurse

- Nutritionist

- Occupational Therapist

- Office Manager

- Optician

- Optometrist

- Painter

- Paralegal

- Paramedic

- Pediatrician

- Personal Trainer

- Pharmacist

- Phlebotomist

- Photographer-option

- Publisher

- Radiologist

- Real Estate Agent

- Receptionist

- Recreation Worker

- Recruiter

- Registered Nurse

- Reporter

- Research Scientist

- Respiratory Therapist

- Retail Salesperson

- Robotics Engineer

- Sales Manager

- School Counselor

- Scientist

- Secretary

- Security Guard

- Server

- Set Designer

- Social Worker

- Software Developer

- Speech Pathologist

- Statistician

- Stockbroker

- Stylist

- Surgeon

- Surveyor

- System Administrator

- Tax Preparer

- Teacher

- Technical Writer

- Telecommunications Specialist

- Therapist

- Tour Guide

- Translator

- Truck Driver

- Ultrasound Technician

- Urban Planner

- Usher

- Veterinarian

- Video Editor

- Waiter/Waitress

- Web Developer

- Welder

- Writer

- Yoga Instructor